Cosmetic Surgery Financing

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Cosmetic Surgery Loans

Cosmetic surgery can boost our confidence or in some cases help us correct natural birth defects. Procedures can vary in price but most will require savings or financing. Luckily, you can finance just about any kind of cosmetic surgery. Depending on your financial situation and the cost of the surgery, the type of financing that is best can vary.

Pre-qualify

Select offer

Finish application

Receive funding

Check offers

in seconds

Won't impact

credit scores

Competitive

payment options

Receive

funds quickly

Compare Rates From Lenders in Our Network

Learn More About Cosmetic Surgery Financing

Keep reading to learn more about cosmetic surgery financing.

Read more - FAQ

+What is cosmetic surgery financing?

Cosmetic surgery financing is any type of loan, payment plan, or line of credit that is designed to help patients cover the cost of their surgery without needing to pay in cash up front.

Cosmetic surgeries and procedures may include liposuction, tummy tuck, breast augmentation, body sculpting, rhinoplasty, plastic surgery, and reconstructive surgery. In most cases, these procedures are not deemed medically necessary with the exception of some reconstructive surgery such as after the removal of a breast as part of cancer treatment. The average cost for many of these surgeries can range anywhere from $5,000 to $10,000 – a very high expense.

Since cosmetic surgery is not typically deemed as medically necessary, the costs associated with these procedures are not generally covered by insurance. Even if your policy does cover some types of plastic surgery such as reconstructive surgery, it is likely that it will be partial coverage.

There are a few different options that cosmetic surgery patients can consider to help fill in the gap. One popular way to finance the cost of a plastic surgery is to use a healthcare credit card like CareCredit that is accepted by thousands of doctors and care providers nationwide.

Another common way to pay for your cosmetic procedure is to use a personal loan. With low fees, competitive interest rates, and flexible loan terms – a personal loan is often the way to go.

Can you get a loan for cosmetic surgery?

You can get a loan for cosmetic surgery through your doctor's office in some cases, or you can take out a personal loan to cover your surgery expenses. Personal loans are a great option to cover any medical expenses or major purchases due to their low interest rates and flexible loan terms. Generally, personal loans have lower interest rates than credit cards or lines of credit.

Personal loans taken out for cosmetic surgery typically come in loan amounts ranging from $1,000 to $50,000, with loan terms ranging from 2 to 7 years. The average interest rate on a personal loan as of 2022 sits right around 10% for borrowers with the best credit scores.

At Acorn Finance, you can check personal loan offers with no impact to your credit score. With access to a network of top national lenders, Acorn Finance allows consumers to receive some of the best personal loan offers available. Our lending partners can offer personal loans up to $100,000 and APRs as low as 6.99%, depending on credit score. To top it all off, our lending partners can help good and bad credit borrowers and some even allow applicants to apply with a cosigner.

Can you get cosmetic surgery financing with bad credit?

Lenders for cosmetic surgery financing typically want to see applicants have a credit score of at least 660 or above. However, even if you have a low credit score, you are not out of options for your financing. You may still be able to obtain cosmetic surgery financing even with bad credit.

One of the most common ways this is done is to use a cosigner or co borrower to qualify for your loan. When you use a cosigner or co borrower, their information is looked at in addition to your own, allowing the lender to give you access to a loan as well as to better interest rates.

As an alternative to hunting down a cosigner, you may still be able to qualify for a loan on your own if you know where to look. Some online lenders will approve loan candidates with bad credit. For example, Upgrade has a minimum credit score requirement of only 560 to qualify and OneMain Financial and LendingPoint have a minimum credit score requirement of only 600.

Do plastic surgeons offer payment plans?

Some plastic surgeons do offer payment plans which allow patients to spread out their surgery expenses over time. Surgeon fees can easily run into the thousands, making payment plans a necessity for many patients. Plastic surgery offices are wise to offer payment plans to their patients as a way of remaining competitive and increasing their potential business. Payment plans consist of equal monthly payments usually made over a short period of time – 12 to 24 months.

Alternatively, you can ask your surgeon if they have a cash discount for paying upfront in cash. If you use an outside personal loan, you may be able to get a cash discount from the surgeon since the lender will typically fund your loan directly rather than paying the medical practice.

Do plastic surgeons offer in-house financing?

Likewise, some plastic surgeons offer financing through their own office without the need to use an outside lender to apply for a loan. This option can be more convenient for many patients; however you should always check around and compare rates first before signing on the dotted line. You may be able to find a much better deal on your own from an online lender such as LightStream, SoFi, Prosper, or Upgrade. Be sure to take into consideration the lender's application requirements, the loan terms, your APR, and any applicable loan fees. Getting prequalified from a few different lenders can help you get a better idea of this as well. At Acorn Finance you can check offers from top national lenders like these and so many more. Within 60 seconds or less you can receive offers with no impact to your credit score.

Plastic surgery financing calculator: how much would a cosmetic surgery loan cost?

To find out the true cost of your cosmetic surgery financing, you should run the numbers through a loan calculator to see what kind of monthly payment and interest payment you can expect to receive. Getting prequalified from a few different lenders will help with this as well.

The total cost of your cosmetic surgery loan will depend on how much cash you put down, what interest rate you receive, the amount of any fees you will be charged by the lender, and how long the repayment period of your loan will be. The longer the loan term – the more payments you will have and the more you will be charged in interest over the lifetime of the loan.

Additionally, your credit score will affect the overall cost of your cosmetic surgery loan by affecting the interest rate that you receive. The higher your credit score – the less you can expect to pay interest over the lifetime of the loan, and vice versa for those with poor credit.

Pros & Cons of cosmetic surgery financing

There are several advantages of using cosmetic surgery financing to pay for your elective procedure. Medical expenses (such as plastic surgery) that are not covered by insurance can be very expensive, and using financing helps make these procedures more attainable. Some forms of financing, such as credit cards with a 0% APR introductory period or a personal loan with low interest, are extremely affordable if you pay back your balance in time. Using financing also allows you to quickly and painlessly cover any additional costs or unexpected expenses such as a second surgery or an extended post-surgery recovery time.

On the other hand, cosmetic surgery financing may tempt consumers into undergoing a costly procedure that they truthfully cannot afford. Before signing on the dotted line, you should make sure that the monthly payment is manageable with your budget, and the loan balance is one that you will be able to pay back. If you are able to pay upfront in cash using your checking or savings account, this is always going to be the best option for handling any major expense.

Discover competitive cosmetic surgery financing offers, all with no impact to your credit score. . . get started now!

Pros & cons of personal loans for cosmetic surgery

Pros

Keep savings intact

Get the surgery you want sooner

Fixed monthly payment

Expand your budget and options

Boost your confidence

Cons

Taking on debt

Surgery may not be necessary

Interest and fees increase cost of the procedure

Time shopping for the right offer

Why choose Acorn Finance for comparing personal loans in cosmetic surgery?

Deciding to get cosmetic surgery can be a big decision for some. And, the last thing we want is to go through the consultation only to find out we can’t afford the procedure. While practices likely hear financial concerns daily, it’s not the most fun thing to mention. At Acorn, you can get prequalified online before or after visiting the cosmetic surgeon's office. Our lending partners can fund loans as a lump sum of cash, so you never even have to mention you aren’t a cash customer. While our main emphasis is on home improvement loans, personal loans are equally practiced at Acorn. Check rates in seconds with no credit score impact at Acorn! We will help fill your life with joy, and all the things you want.

How do people afford cosmetic surgery?

Cosmetic procedures and surgery can vary dramatically in price. In today’s modern world, it seems as if cosmetic surgery is becoming more and more common, but how are people affording it? While some may have the cash on hand, others may not. Life is short, so even if we don’t have the cash we need to get the things we want, we still deserve them, and there may be ways to make things more affordable. Cosmetic surgery financing is one of those ways.

The demand for cosmetic surgery financing is present; therefore, more practices now offer payment plans and financing. Some may even offer promotional financing offers (i.e., no interest if paid in full within 6, 12, or 18 months. However, for expensive procedures, the promotional financing offers may not adhere to your budget. If the principal is not paid in full during the promotional period, it can result in extremely high interest. Additionally, it may be hard to qualify for.

No matter how badly you desire cosmetic surgery, you will want to be mindful of the costs associated with financing. Before sliding a credit card, pause for a second to consider other options. If financing or payment plan options associated with the practice do not pencil or are not offered, you may want to consider a personal loan. Personal loans are funded as a lump sum and usually have few spending restrictions. This can expand your budget and your options when it comes to choosing a practice.

To recap, here are some options individuals can leverage to afford cosmetic surgery:

- Payment plans or financing associated with the practice

- Personal loans

- Credit cards

- Saving up the cash

What credit score do you need to finance surgery?

Credit score requirements can vary by lender and other factors, too. For example, an applicant requesting $10,000 may face more strict requirements than an applicant requesting $1,500. Additionally, an applicant requesting a 5-year loan compared to a 1-year loan may face more strict requirements. Lenders face risk, and while that’s the business they’re in, they need a way to justify the risk. Higher loan amounts and longer repayment periods can present increased risk, as can a borrower with a low credit score. With that being said, you may want to check your credit score before applying for cosmetic surgery financing. If you’re worried about qualifying, you may prefer to get prequalified from the comfort of your own home to avoid any embarrassment. At Acorn, you can check personal loan offers up to $100,000 with no credit score impact remotely. Offers will be more likely to be returned for borrowers with fair, good, average, or excellent credit. Most lenders on the Acorn Finance platform have a credit score cutoff of 600 or above.

How do you find the best personal loans for cosmetic surgery?

With a handful of lenders to turn to for personal loans, finding the best offer can be overwhelming. As you compare offers compare details such as:

- APR

- Prepayment penalties

- Discounts (i.e. autopay discounts)

- Borrower perks (i.e. user-friendly portals or credit monitoring services)

- Monthly payment

- Spending restrictions

- Funding time

While you can check offers from lenders individually, or the cosmetic surgery practice may be able to connect you, ideally, you can find a way to compare multiple offers in one place. At Acorn, you can submit personal information to check offers with no credit score impact. We can streamline the process of finding the best personal loan offers via our safe and secure platform. We partner with top national lenders to help consumers experience the difference of online lending done the right way.

When would a personal loan for cosmetic surgery be worth it?

Cosmetic surgery may be superficial, but for some, it’s important and helps us feel better about the bodies we live in. And, there’s nothing wrong with that. If you feel that cosmetic surgery can boost your confidence and better your life, go for it. We should take advantage of opportunities that help us live our best lives, as long as they don’t put us in a bad financial position. Slice open the decision before making it and consider the consequences of the cosmetic surgery loan as well as the benefits.

Here are some justifications for cosmetic surgery financing:

- Boosts confidence

- Keep savings and cash flow healthier

- Fixed monthly payment

- Expands budget

- Creates opportunity to work with better surgeons

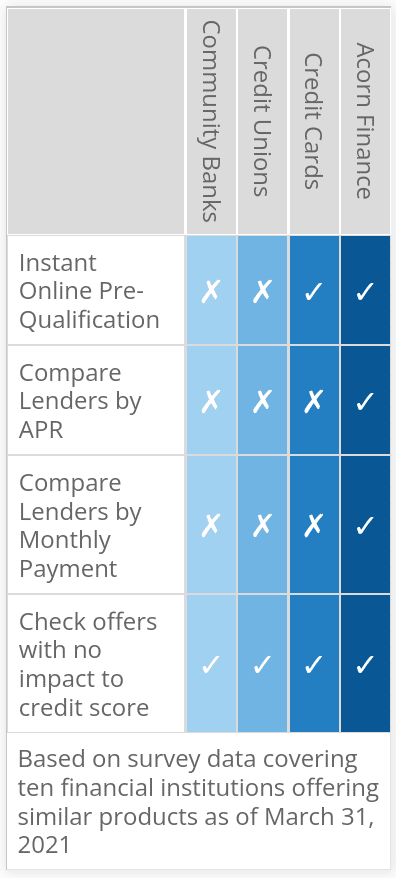

How Does Acorn Finance Compare?

How can I get a personal loan fast?

Check OffersCompare Rates From Top Lenders

$1000 Loan Calculator

Are you a contractor?

Generate more revenue with Acorn Finance.

Offer customers the ability to finance their dreams with zero dealer fees.

Get StartedPopular Home Improvement Projects

Barn Financing Options

One home, endless possibilities