Best Online Loans With Instant Approval For Bad Credit

Get a personalized quote for instant loans in 60 seconds with no impact to your credit score

How much would you like to finance?

Instant Loans Online For Bad Credit

What is an instant loan?

Whether you’re excited to make a big purchase, or you’ve encountered an emergency, you might need a loan – and fast for that matter. Loans that are funded within a day or two of approval, can be considered instant loans. Before we go into more detail, let’s review the two main types of loans: secured and unsecured. Secured loans require collateral, while unsecured loans do not. If you need money quickly, you’ll likely want to opt for an unsecured loan, as secured loans may take longer to receive approval and funding. So, what kind of options are available? Think credit cards, personal loans, or a loan from a friend or family member. Before pursuing an option though, even if you’re in a hurry, make sure you try to compare options and understand what you’re committing to. At Acorn Finance, our lending partners can fund approved loans in as little as 1-2 business days, although funding times can vary. Start by checking offers (no credit score impact) and comparing them side-by-side. Our network of top national lenders work together to help you find the best personal loan offer in minutes.

How To Get A Loan With Instant Approval

Pre-qualify

Select offer

Finish application

Receive funding

Check Offers on Instant Loans Online

Check offers

in seconds

Won't impact

credit scores

Competitive

payment options

Receive

funds quickly

Compare Rates From Lenders in Our Network

What lenders offer instant loans?

Who you accept a loan from can impact how it works out. Some lenders are easier to work with than others. Furthermore, you will need to qualify and be approved for a loan, but what you qualify for can vary by lender. This further proves the importance of comparing loan offers. We get it, you’re looking for an instant loan, but at Acorn Finance, comparing loan offers only takes a few minutes. Submit some basic personal information and check offers with no credit impact. Our network of top national lending partners includes reputable lenders such as the following.

- Upstart

- Best Egg

- OneMain

- LightStream

How do instant loans work?

Most instant loans are unsecured loans, based on your creditworthiness. Here’s how most instant loans work:

- Get pre-qualified: The first step toward getting a loan is usually to get pre-qualified. During this stage the lender can do a soft credit pull (in most cases) and generate a pre-qualified offer, based on your request. The offer may be contingent upon certain things such as proof of income, residency, and so forth. In addition, most offers have an expiration date.

- Accept loan offer: Once you’ve found the loan offer you want to use, you can accept the offer. Most loans will go through an underwriting or approval process where the lender verifies the information the borrower submitted. Once confirmed, the lender can approve the loan.

- Receive funds: Once a loan is approved, the lender can release funding. Most unsecured personal loans or instant loans are funded as a lump sum (minus certain fees such as origination fees). Some lenders can deposit funds right into your specified bank account. With few spending restrictions you can use the funds as permitted.

- Repay the loan: Most unsecured personal loans or instant loans are fixed. This means the APR and monthly payment will not change. You should know when repayment begins, when your payment is due each month, and how much you need to pay each month and for how long.

Ready to check offers? Visit Acorn Finance.

Where can you get an instant loan?

When it comes to borrowing money, you will want to work with a legitimate lender. While searching for instant or fast loans, be mindful that you might encounter predatory lenders or companies. Regardless of the hurry, do your research and make sound financial decisions. There are plenty of instant loans that are legitimate. At Acorn Finance, we work with online lenders that are fully vetted. Some even have physical locations, that might be in your local area. In minutes you can browse personal loan offers, allowing you to choose the one that works best.

Here are a few sources that you can find instant loans:

Banks: Local banks may offer instant loans or personal loans with the option for in-person service. In some cases, banks can offer an online process, too, so you might not be within a local radius to work with a bank.

Online lenders: The online lending marketplace is growing as the demand for convenience soars. Online lenders can have reduced overhead, so they may be able to pass that savings along to consumers, and or afford to take more risk. Online lenders may have less strict requirements.

Credit unions: Credit unions are nonprofit financial institutions known for serving members with competitive rates and friendly service. Some credit unions specifically serve populations such as teachers or government employees.

What are the best ways to use an instant loan?

If you are using an unsecured personal loan with fast funding through an Acorn Finance lending partner, there will be few spending restrictions. Therefore, you can use it as you see fit, as long as it’s within the guidelines. If your intended use of the loan can help you get ahead or benefit you, then it’s up to you to make the final decision. While some advise not to borrow money you don’t need to borrow, we all find ourselves in situations unique to our own life. Weigh the pros and cons, and make sure you can afford to repay the loan. Some common uses of instant loans include:

- Car repair loans

- Home improvement loans

- Furniture loans

- Emergencies (for good and bad credit)

- Moving expenses

Can I get an instant loan with low income?

Income can play a role in qualifying for a personal loan. Different lenders will have different requirements, but in general, most want to ensure you can afford to repay the loan. Be mindful of what you can afford when requesting a loan amount. To help you qualify for a larger loan, you might want to apply with a co-signer or consider a secured loan. Find out if you qualify for a personal loan with no credit score impact at Acorn Finance. We help real people find real loans, all the while keeping it real.

Can I get an instant loan with bad credit?

Credit is another requirement that lenders can consider, but requirements can vary by lender. From your credit history to your credit score, you might want to check your credit before applying for a loan. Are there any ways you can boost your score before taking out a loan? There might be, which can increase your chance of approval.

Offers will be more likely to be returned for borrowers with fair, good, average, or excellent credit. Most lenders on the Acorn Finance platform have a credit score cutoff of 600 or above.

Can I get an instant loan with no credit check?

There are some kinds of loans that do not require a credit check, such as payday loans, car title loans, and Pawn Shop loans. Most are short term loans for small amounts that may not be cost-effective. If you’re concerned about credit challenges, try finding a lender that works with lower credit scores, otherwise known as subpar lenders.

How can I get a $2,000 instant loan?

One of the best ways to borrow $2,000 in a hurry is to use a personal loan. In the personal loan world, $2,000 is a relatively small amount, with loan amounts up to $100,000 available, depending on credit score. Compared to other alternatives that might not be as consumer-friendly, such as payday loans or car title loans, personal loans are available in amounts of $2,000 for borrowers who qualify. Alternatives are often only available for a few hundred dollars. To get a $2,000 instant loan, you’ll first need to find a lender you can qualify with, and one that provides an offer that works for you.

At Acorn Finance, you can check offers from top national lenders through our marketplace. Take advantage of the convenience to receive offers in minutes, and the leisure of choosing the one that works best. Once you’ve selected a loan offer, proceed with the lender of your choice to finalize the approval. Submitting complete and accurate information during the initial process to check loan offers, and any other prompts for information to follow, can help the process go smoother. On approved loans, our lending partners can deliver funding in as little as 1-2 business days, although funding times can vary.

What if I have bad credit history, can I still get an instant loan?

Everyone deserves a second chance, and part of rebuilding your credit may involve borrowing money and repaying it on time. However, bad credit can limit your options. Offers will be more likely to be returned for borrowers with fair, good, average, or excellent credit. Consider applying with a co-signer who has good credit, or investing time into boosting your credit score. There are many credit monitoring apps available (some for free) that provide access to your credit report with recommendations on how to improve your score. Whether your credit is being drug down by something you are unaware of or not, monitoring your credit score on a regular basis can help you learn more about what makes it go up and down.

Can I get an instant debt consolidation loan with bad credit?

Some personal loans can be used as debt consolidation loans. Holding too much debt can cause your credit to suffer.

As you search for a way to improve your credit, finding a way to consolidate debt can make the light at the end of the tunnel glimmer through. In the event you use a personal loan for debt consolidation, you could pay the old debt off with the personal loan. In some cases, the lender backing the personal loan can offer direct payment to creditors. Once creditors are satisfied (loan paid in full) you can get a positive remark on your credit history. With the new personal loan, you can pay one fixed monthly payment over a predetermined period, helping you shovel your way out of debt.

What are other ways to get instant loans?

As we mentioned earlier, you might find some options that match the idea of an instant loan, but the more you learn about them, the less ideal they sound. The lending business is a profitable industry, and lenders and financial institutions know when individuals need money quickly, and or, have credit challenges, they may feel a sense of desperation. As a result, financial products may be marketed in a way to make them appear they deliver what the consumer needs, but the finer details may not be so favorable. Here are some instant loan alternatives that you might want to think twice about.

- Payday loans and payday advances: Payday loans or advances are usually in small amounts, such as $500 or less. In most cases, you will need to repay them within the pay period, or by the time you get your next paycheck. With few requirements, they can lure in borrowers. Payday loans usually cost about $10-$30 per every $100 borrowed, according to the Consumer Financial Protection Bureau.

- Car title loans: If you have the title to your vehicle, or a vehicle in your name, you can use a car title loan. With this type of loan, you would be using the car as collateral. While these loans might have few requirements, they usually have high interest rates and are short term.

- Pawn Shop loans: Pawn Shop loans leverage valuable collateral , such as jewelry or electronics. You bring your collateral to the Pawn Shop, and they appraise it. If you accept, you can borrow money using the collateral, but if you don’t return to repay the loan by the specified date and time, they can sell your collateral or gain ownership of it. In most cases, Pawn Shops offer 30-60 days to repay the loan.

Lastly, none of these types of loans help improve your credit score if you follow through. Therefore, if you need to borrow again, you might find yourself in the same situation.

Alternatives to high-interest debt

The idea of borrowing money can sound good, and the monthly payment can be within budget, but as you start to look at the cost, you may start to second guess a loan. While there’s value to keeping cash in your savings, and or taking a loan in some cases, you will need to determine what’s best for your situation. Whenever possible, check offers to find a loan with the most favorable offer, this can include APR. In addition, consider the repayment period. While a longer repayment period might help keep that payment down, it can drive up the total loan cost.

Using credit cards is a common way to afford things, or keep your check account in tact, but credit cards can be costly. While it might take a little more effort to get a personal loan, it’s a good alternative for borrowing a fixed amount of money. When applying for a personal loan, you might be able to apply with a co-signer. Ideally, a co-signer has good credit and income, thus increasing your chance of approval. This is another way to help keep the APR down.

Some may even use a personal loan to consolidate credit card debt into one loan with a fixed monthly payment. Personal loans are versatile and usually have a fixed monthly payment, making them an attractive way to borrow money quickly. The option that works best can ultimately come down to details such as what you qualify for and how much you need to borrow.

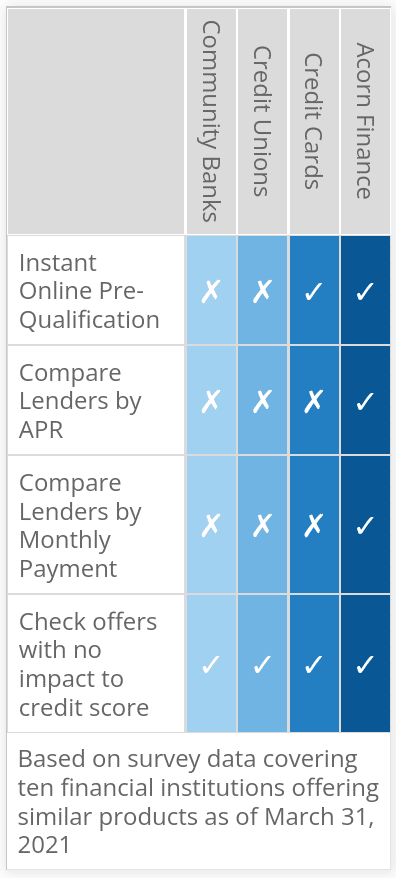

How Does Acorn Finance Compare?

Compare Rates From Top Lenders

Instant Loan Calculator

Are You A Contractor? Stop Thinking & Start Doing with Acorn Finance.

Offer customers the ability to finance their dreams with zero dealer fees.

Get StartedPopular Home Improvement Projects

Barn Financing Options

One home, endless possibilities