Frequently Asked Questions

What are Acorn Finance’s credit requirements?

Acorn Finance is an online lending marketplace where you can easily compare rates and monthly payments from different lenders without impacting your credit score. Anyone can check for offers on Acorn Finance.

However, each lender that participates on the Acorn Finance marketplace has a specific set of credit requirements that helps them determine, based on risk, who to lend money to. These requirements typically includes things like:

- Your credit score

- Your employment status and income level

- Your credit history

- Your debt-to-income ratio1

1 Lenders assess whether your income can support both your current debts and the new loan to determine your ability to repay.

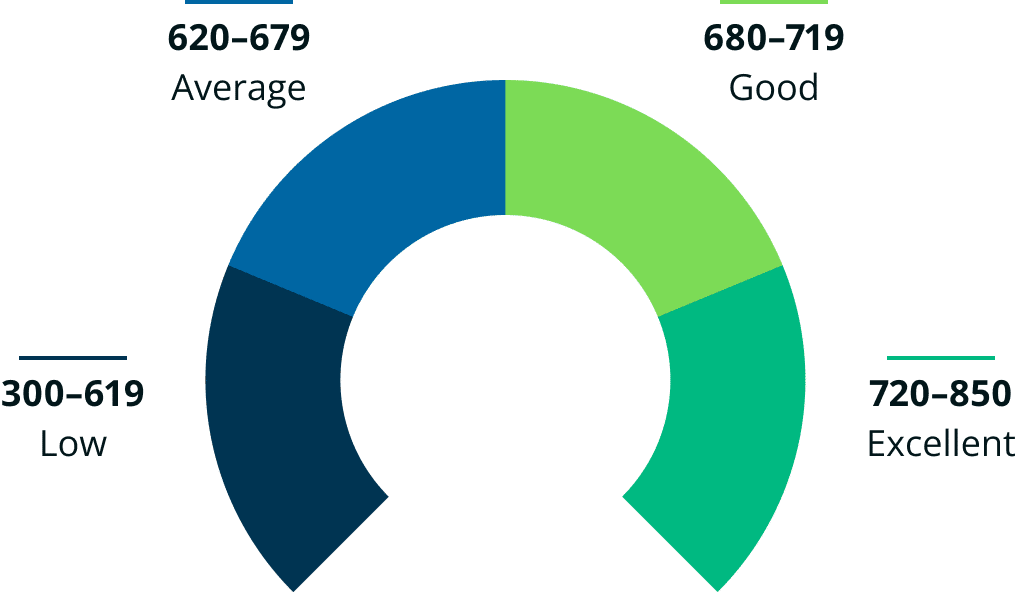

Generally speaking, the minimum credit score our lenders consider is around 560. They also look at other information from your credit report to determine your eligibility for a loan. For example, if you have a recent bankruptcy filing or have missed payments on loans or credit cards within the past few years, the lenders may not provide offers.

If your credit history is challenged, adding a co-borrower (such as a parent or spouse) with a stronger score can help.

Still have questions?

Who is Acorn Finance?

Acorn Finance is a lending marketplace where the nation’s premier online consumer lenders pre-qualify customers for personalized loan options in 60 seconds, with no impact to the homeowner’s credit score. Acorn Finance uses an initial soft credit inquiry to provide access to competitive, fixed-rate loans through a fast and easy online process.

What types of lending options does Acorn Finance offer?

PERSONAL LOANS: A personal loan is a financial product that allows a customer to borrow money now, and pay it back over time by making fixed monthly payments. Personal loans have fixed rates of interest and typically have terms ranging from 2–12 years. They also may be unsecured (no collateral) or secured (collateral required) depending on the specifics of the offer.

PERSONAL LINE OF CREDIT: A line of credit is a financial product that customers can borrow from at any time based on a preset limit. As long as the customer’s account is open and their credit remains in good standing, they can borrow up to the maximum amount and pay interest only on the amount you actually borrow. As it is paid off over time, that credit may once again become available for the customer to borrow from.

How much can you borrow with Acorn Finance?

Acorn Finance’s network of lenders extend loans from $1,000 up to $100,000 for qualified consumers.

What loan terms are available?

Applicants with excellent credit may be eligible for competitive rates and extended repayment terms of up to 144 months (12 years).

For what purpose can the borrowed funds be used?

Funds can be used for any home improvement expense.

How long does the process take?

Qualified applicants can be approved quickly during business hours and may receive their funds as soon as within one business day.

Are there any fees?

Acorn Finance's network of lenders charges no penalties for early repayment and no processing charges on loans over $40,000. For loans under $40,000, some lenders may charge an origination fee between 1–6%. No-fee options are highlighted on the offers page.

Does Acorn Finance allow co-borrowers?

Yes. Co-borrowers are encouraged to apply and can be added immediately after the initial applicant submits their information.

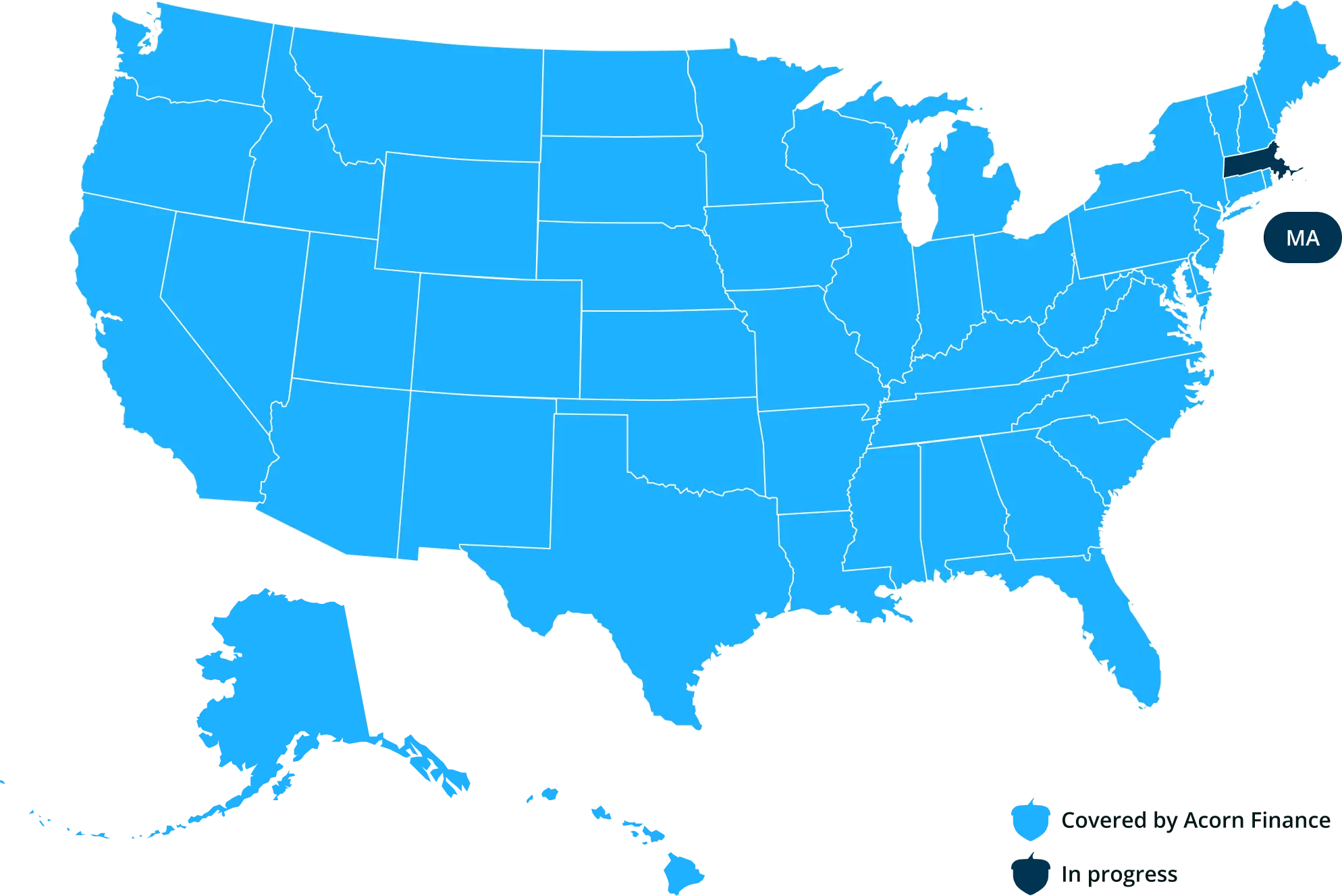

Does Acorn Finance cover all 50 states?

Acorn Finance is available online in the United States via internet-connected smartphones, tablets and personal computers nationwide except for in Massachusetts. We’re rapidly expanding to all 50 states so please check the status of our current coverage area above to determine if we are serving your state.

State coverage map

Acorn Finance currently covers 98% of the U.S. population. If you live in the state of Massachusetts that is not covered, please be patient as we’re in the process of obtaining a license.