Offer pre-qualified financing to your customers. $0 Dealer Fees.

Get setup today

If your Agency isn’t already enrolled, follow these simple steps to get started:

- Please fill out the quick enrollment form with your Agency details.

- Once the form is submitted, Acorn Finance will enable your location to offer Financing.

- You’ll then start the onboarding process with our Financing Advisors.

The Acorn Finance Advantage

Offering financing through Acorn Finance can be a game-changer for you and your customers.

For Unigroup Agency

100% Free

Ready for all Unigroup Agencies

Offers for Good and Bad Credit

For Customers

No Credit Impact for Checking Offers

Competitive rates & terms

Pre-approval in minutes

How It Works

Acorn Finance is easy to use and offer.

Talk about Financing Early in your Sales Process

Mention “low monthly payment options” and share the Financing PDF early to make sure the customers know their options from the start.

Offer Financing to Customers

Provide customers with financing options early in your sales process by sharing your unique application link directly. Alternatively, customers can automatically view financing options when they accept your quote within the move portal.

Customers Apply & Get Instant Offers

Acorn Finance provides real-time loan offers from top lenders.

Your customer gets paid, then pays you

Once approved, funds are disbursed directly to your customer, and we’ll keep you informed along the way with email notifications.

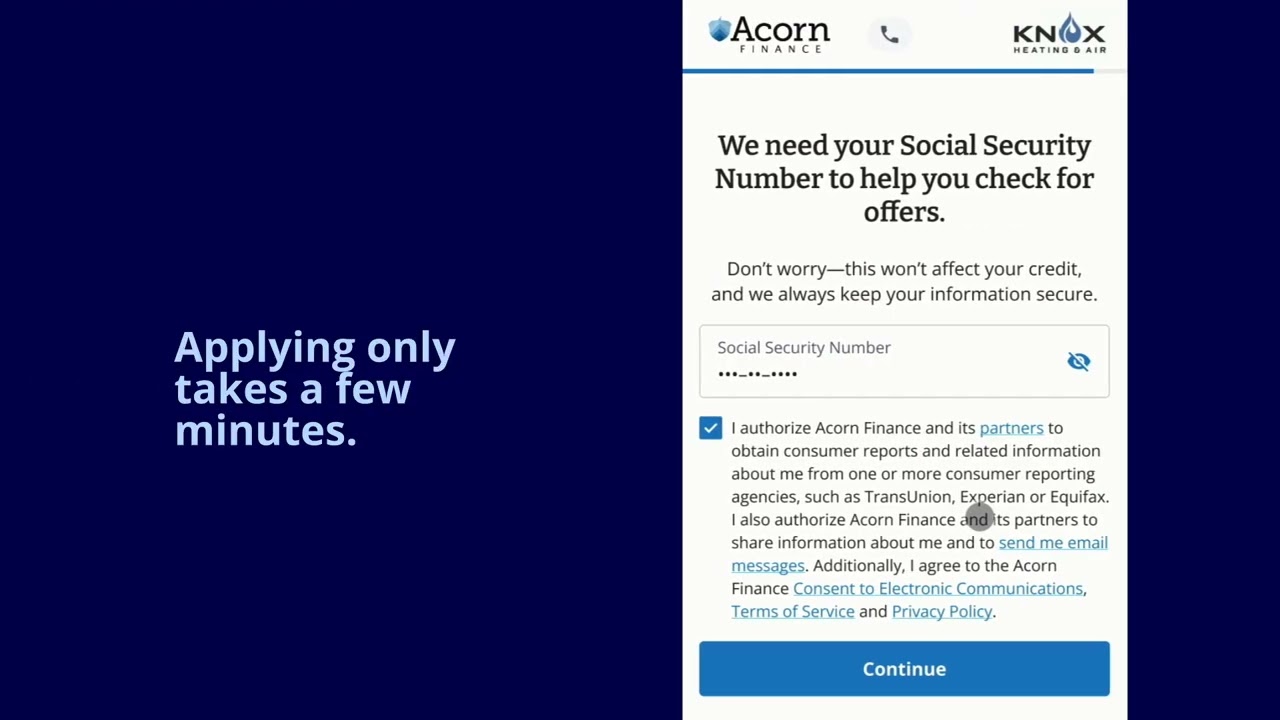

Your Customer’s Experience

See what your customers will see when they apply through Acorn Finance.

Acorn Finance’s Lending Products

We’ll provide your customers with options from 12+ of the nations top lenders.

Featured lender

|

$5,000-100,000

Loan Amount

|

7.99-25.299%

APR

|

5–20 years

Terms

|

660

Minimum Credit Score

|

Disclaimer

*Your loan terms, including APR, may differ based on loan purpose, amount, term length, and your credit profile. Rate is quoted with AutoPay discount. AutoPay discount is only available when selected prior to loan funding. Rates without AutoPay are 0.50% points higher. To obtain a loan, you must complete an application on LightStream.com which may affect your credit score. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Payment example: Monthly payments for a $25,000 loan at 10.19% APR with a term of 12 years would result in 144 monthly payments of $301.52.![]() Truist Bank is an Equal Housing Lender. ©️ 2025 Truist Financial Corporation. Truist, LightStream, and the LightStream logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners. Lending services provided by Truist Bank.

Truist Bank is an Equal Housing Lender. ©️ 2025 Truist Financial Corporation. Truist, LightStream, and the LightStream logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners. Lending services provided by Truist Bank.

Managing Acorn Finance

Talk about Financing early in the process and offer it as a payment option to your customers.

Acorn Finance is ready and available for you to start talking about.

All you have to do is inform your customer you have financing early in the sales process. If they are interested, you can send them a link to apply for financing.

If your customer applies and gets offers, you can then see their progress along the way.

Be on the lookout for notifications for when your customer completes their application, or gets funded. You can use this as a way to reach out to them to close the deal.

Calculate your customer’s monthly payments

Use the calculator below to explore real-time rates and terms that are available on the Acorn Finance Marketplace.

Frequently Asked Questions

Learn more about Acorn Finance and our partnership with Unigroup.

Does every Unigroup Agency qualify for Acorn Finance?

Yes! 100% of Unigroup Agencies have access to the Acorn Finance integration. There are no qualification requirements on your end. This integration is designed to make offering customer financing simple and accessible to everyone.

Are there any fees associated with using Acorn Finance?

How does the payment process work with Acorn Finance?

Your customer applies for and, if approved, receives a loan directly from the lender. The lender then funds the customer, and your customer pays you directly for the services rendered. You get paid as you normally would, and Acorn Finance simply facilitates the loan process.

How quickly can my customers get funded through Acorn Finance?

Funding speed varies by lender, but some lenders can fund your customers in as little as 24 hours. This allows your customers to move forward with projects quickly, and you to get paid faster.

Are there any restrictions on what types of purchases can be financed through Acorn Finance?

The Acorn Finance ‘Direct to Consumer’ platform allows you to assist customers with any interstate move for both United and Mayflower. Additionally, it can be used for any of your own authority local and intrastate moves.

Where is Acorn Finance available?

Acorn Finance is available in most of the continental United States. To see if your specific area is covered, please view our full coverage map.

Get in Touch

Interested in learning more? Contact a Financing Advisor from Acorn Finance to explore how our financing solutions can help grow your business.