Offer fast & flexible home improvement financing

- No fees and no surprises

- Loans up to $100,000 and terms up to 20 years

- Same-day setup and expert contractor support

Fast, simple, and hassle-free for everyone

For Your Customers

- Apply online in minutes

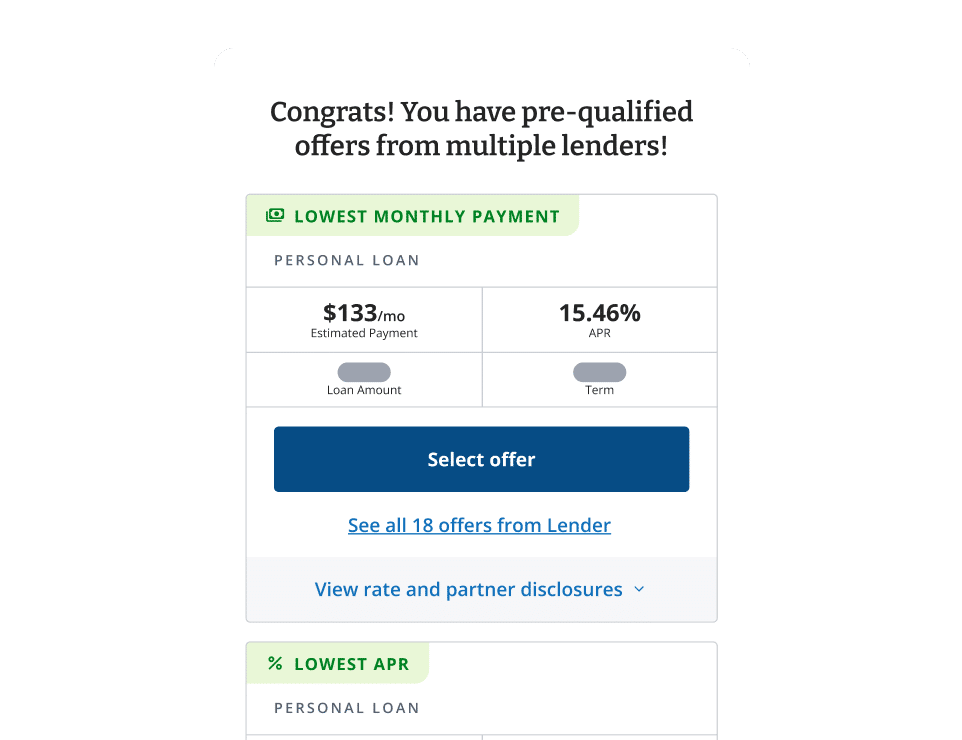

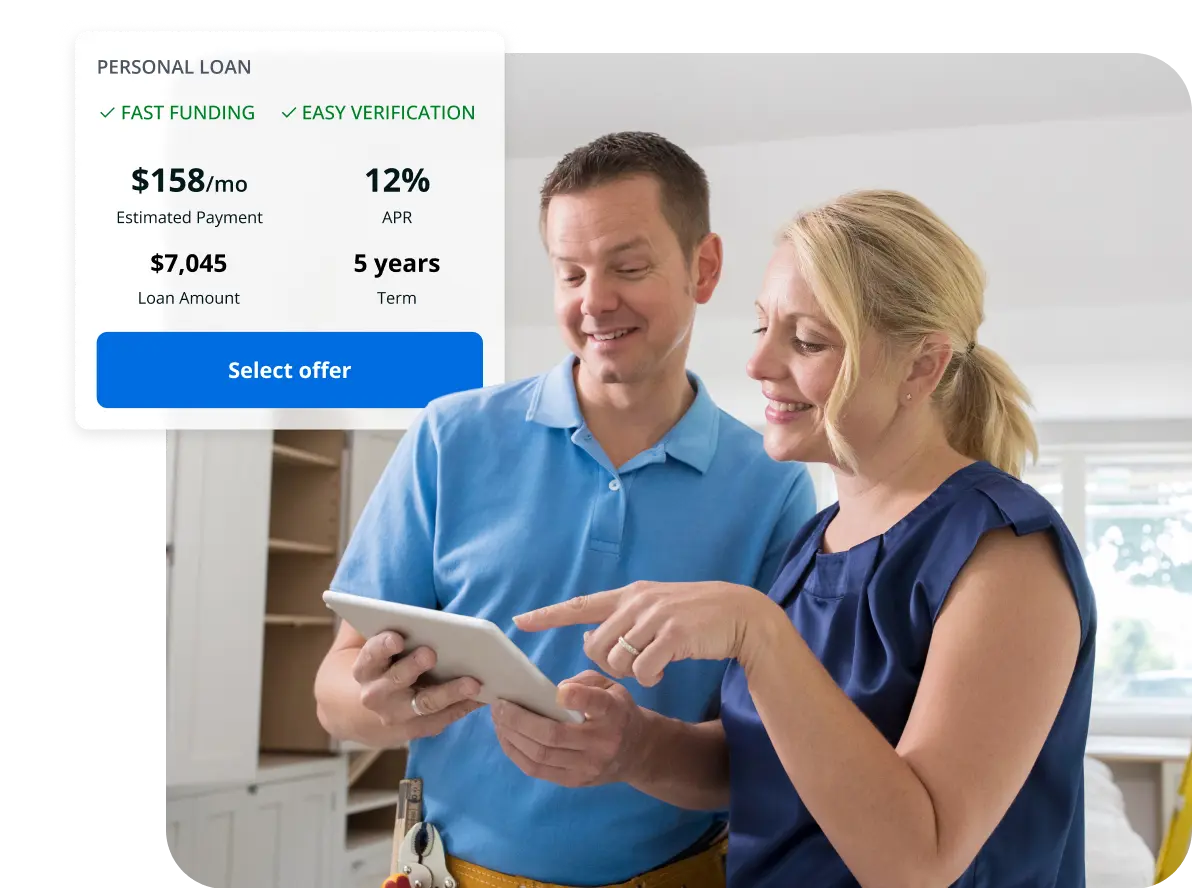

- Compare multiple loan offers side-by-side

- Choose affordable monthly payments with no impact to their credit score

- Get funds quickly and start the project sooner

For You

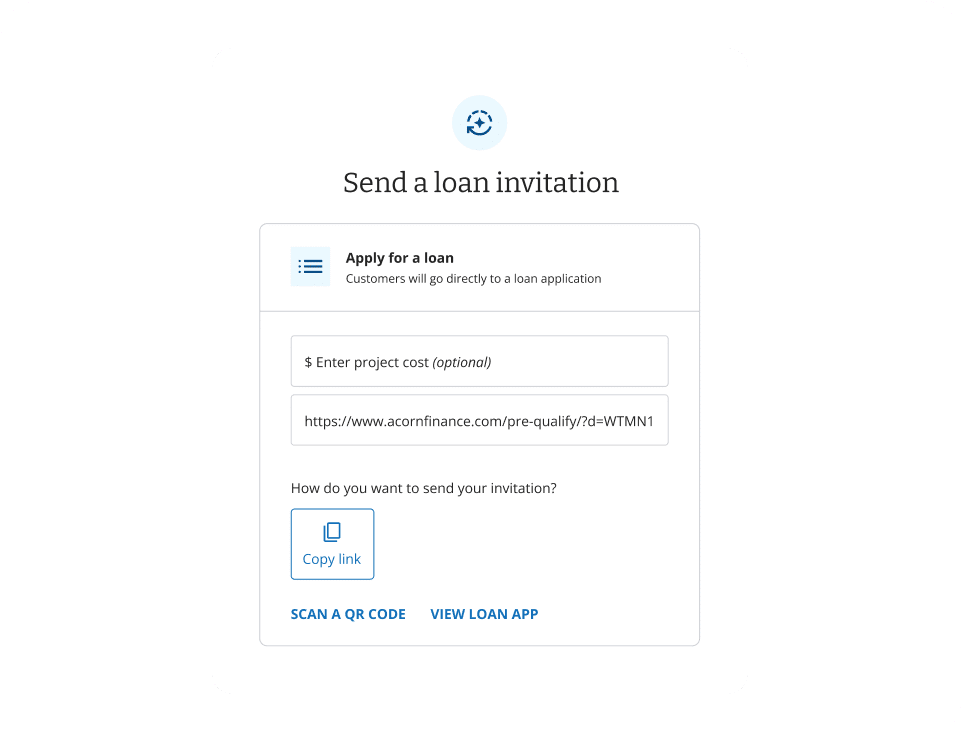

- Share your custom financing link via text, email, or estimate

- See your customer’s Financing status through our Portal

- Get paid upfront once your customer is funded

- Close more jobs and grow your average project size

Your quick guide to Acorn Finance

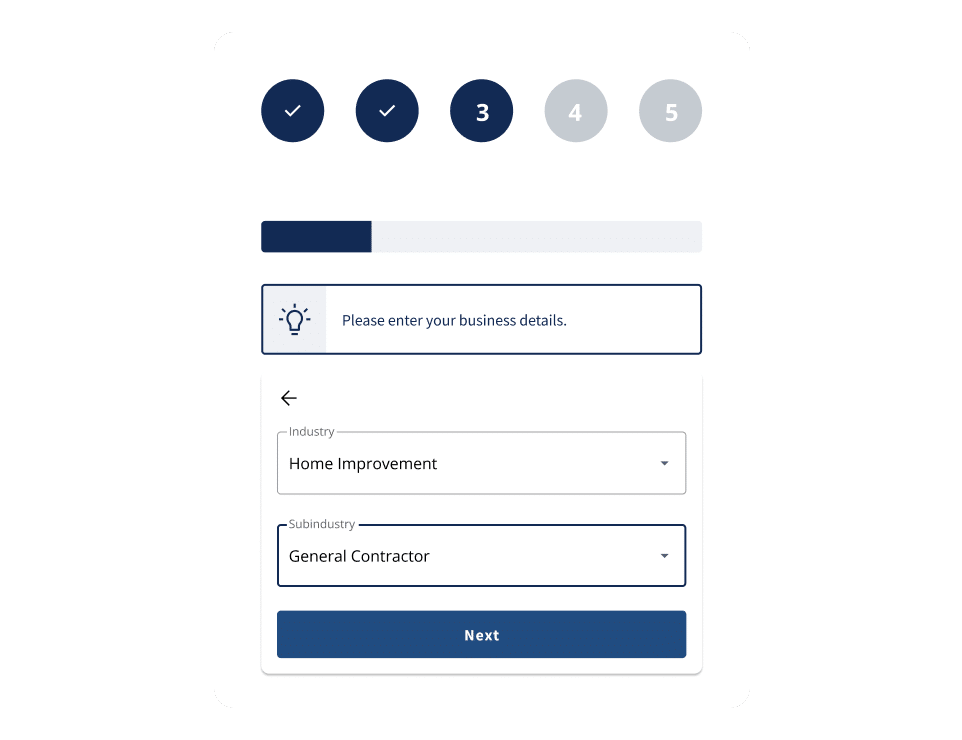

Create your contractor account in just minutes—no fees, no obligations. You’ll get your own personalized financing link you can share with customers right away.

Add your web link to your estimates, invoices, and website, or send it via text or email. Customers can apply anytime, from anywhere, without you having to walk them through the details.

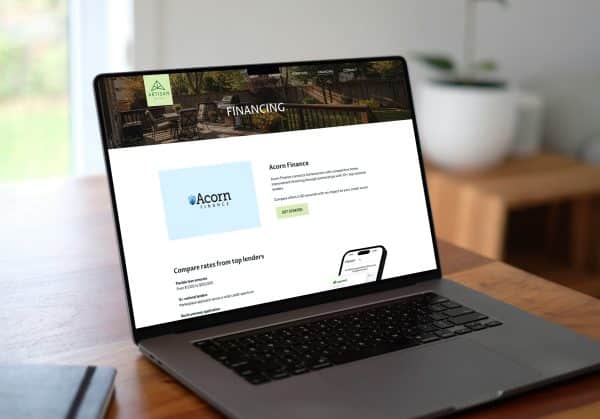

Your customers see multiple offers from our network of top lenders in minutes, with no impact to their credit score. They choose the option that works best for their budget.

Once your customer accepts an offer and is funded, you get paid upfront. No waiting for installments, just the green light to start work right away.

Smart Patio Plus

Don’t say it. Show it.

Instant access

How Acorn Finance Compares

- NO CONTRACTOR FEES

No dealer, subscription, sign-up or credit card fees. - MARKETPLACE OF MULTIPLE LENDERS

- SAME-DAY SETUP

- SIMPLE PROCESS

No paperwork or underwriting expertise needed. - CREDIT SCORE RANGE

- RESPONSIVE SERVICE

Industry advisers (not sales people) stay ready to help you and your customers.

-

-

-

-

-

- 560–850

-

-

-

- 640–850

-

- 560–850

-

- 660–850

One portal to get the big picture

Compare rates from top lenders

Still have questions?

What is Acorn Finance?

Acorn Finance is a platform that helps contractors offer fast, affordable financing to their customers. We partner with multiple reputable lenders so your clients can get competitive loan offers, often in minutes, while you get paid in full, upfront.

How does Acorn Finance help my business grow?

By offering financing, you open the door to bigger projects, higher close rates, and customers who might otherwise delay or scale down their purchases. Financing can remove price hesitation and help you stand out from competitors.

How do I offer financing to my customers?

You will receive a unique link or digital application you can share with customers via email, text, or QR code. They fill it out, see offers from multiple lenders, and choose the best one for them.

Do I need to manage loan approvals or paperwork?

No. Acorn Finance handles the entire loan process with our lending partners. You focus on your work while we handle the financing logistics.

How quickly do I get paid?

In most cases, contractors are paid directly by the customer using the loan proceeds within 1 to 2 business days after project approval.

How fast can my customers get approved?

Prequalification can happen in under a minute with no impact on their credit score. Final approval often comes the same day2.

What types of projects are eligible?

Home improvement, remodeling, HVAC, roofing, landscaping, solar installations, and more. If it is a legitimate home service or improvement project, we can likely finance it.

Are the interest rates competitive?

Yes. Because we partner with multiple lenders, customers can compare real, personalized loan offers to find the most affordable option.

How much does it cost to use Acorn Finance?

Offering financing through Acorn Finance is free for contractors with no setup costs and no monthly fees. Our lending partners pay us when loans are originated.

Do I need to meet certain qualifications to sign up?

We work with licensed contractors in good standing. During onboarding, we will verify your business credentials.

Is Acorn Finance secure?

Absolutely. We use bank-level encryption to protect customer data, and only trusted, vetted lenders are part of our network.

Will my customers’ credit scores be affected?

Prequalification is a soft credit check and will not impact their score. A hard inquiry is only performed once they choose and proceed with a lender.

How do I sign up?

Click the “Sign Up” button, fill out our quick online form, and start offering financing instantly.

What support is available?

We offer live onboarding assistance, marketing materials, and customer support to help you successfully integrate financing into your sales process.

Fill out the form below to get in touch.

Related articles

Offer Financing. Close More Jobs.

Start sending customers pre-qualified loan offers with $0 dealer fees and no minimum requirements.

Start now