Platform Insights from Acorn Finance – Q2 2024

- Average project amounts on the platform trended upward vs. Q1

- Positive shift in APRs on the platform

- Average terms of loans slightly increased

Welcome to the July edition of the Acorn Finance Contractor Newsletter! We’re thrilled to bring you the latest updates and insights from our platform to help you better understand what’s happening with rates and terms on the Acorn Finance Lending Marketplace.

Platform Insights

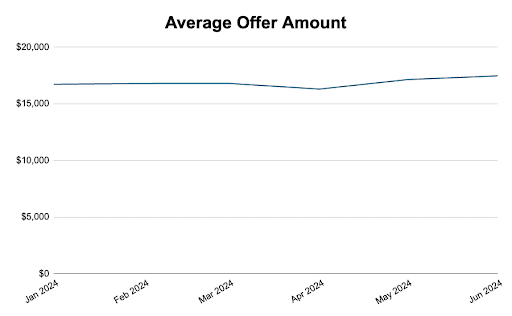

Average Offer Amount

In June 2024, the average offer amount on our platform saw its highest peak YTD of $17,465, representing a 4% increase over the end of Q1. While the average offer amounts for Q2 vs. Q1 remained relatively flat, offer amounts in both May and June trended upward. This trend shows an increasing demand for financing solutions among customers, creating opportunities for contractors to take advantage of.

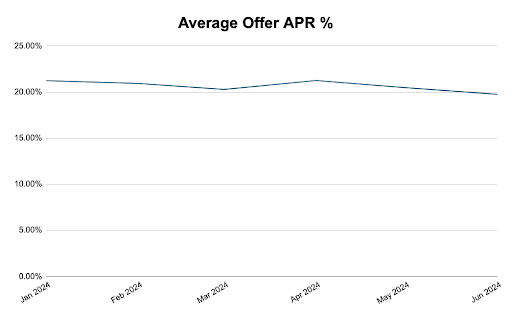

Average APR

We’re pleased to report a positive shift in average offer APR, which decreased by 1.5% in Q2 2024 compared to Q1 2024. This reduction signifies improved affordability for customers seeking financing options, potentially leading to increased conversion rates for contractors.

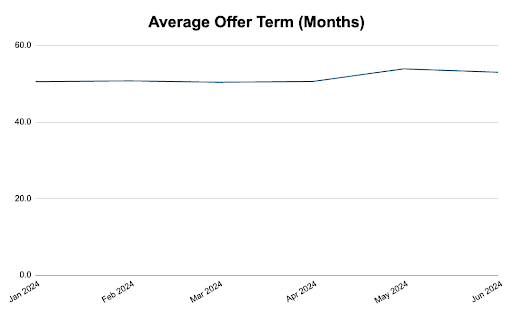

Average Term

The average offer term in June 2024 stood at 53 months, increasing slightly from the Q1 average of 50 months. This consistency underscores the reliability of financing terms available on our platform, providing contractors and customers alike with predictable and manageable payment structures.