Swimming Pool Financing in Texas For Good & Bad Credit

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Best Pool Loans in Texas

Pool Financing Near Me

Whether you’ve lived in Texas for one summer or many, you know how good it feels to cool off in the pool on a hot, humid day. Texas homeowners desire a pool in the privacy of their own backyard, but may not realize just how attainable one is. Pool financing in Texas can assist homeowners with building or installing a pool. Pool financing in Texas can even be used for pool repairs.

How To Apply For Pool Financing in Texas

Pre-qualify

Select offer

Finish application

Receive funding

Check offers

in seconds

Won't impact

credit scores

Competitive

payment options

Receive

funds quickly

Compare Rates From Lenders in Our Network

Learn More About Pool Financing in Texas

Below, we'll go over some of the best ways to finance your new pool and provide you with some resources to get started. So read on and get ready to take the plunge into pool ownership!

Read more - FAQ

+Can you get a swimming pool loan in Texas?

In Texas, as in many other states, it is possible to finance the purchase of a swimming pool with good or bad credit through a home equity loan, personal loan or other avenues of financing.

However, there are a few things to keep in mind before taking out a loan for a pool. First, home equity loans typically have lower interest rates than personal loans, so they may be a more cost-effective option. Second, when using home equity to finance a pool, it is important to be aware of the potential risks.

If you default on the loan, you could put your home at risk of foreclosure. As such, it is important to make sure that you can comfortably afford the monthly payments before taking out a loan.

Finally, it is also worth considering alternative financing options, such as private loans from family or friends or personal loans. Private loans often come with lower interest rates and may be more flexible in terms of repayment terms. Personal loans on the other hand do not require collateral or money down. They can be a great choice or less expensive swimming pools. Ultimately, the best way to finance a pool will vary depending on your individual financial situation.

How to finance a pool in Texas?

If you're thinking about financing a pool, there are a few things to keep in mind. First, consider the cost of installation. While some pool companies offer financing options, others require full payment upfront. Second, think about the ongoing costs of maintenance.

As mentioned above, chemicals and filtration can be expensive, so be sure to factor those costs into your budget. Finally, consider the value that a pool can add to your home. In addition to being a great source of recreation for your family, a well-maintained pool can also increase the value of your property.

When it comes to financing a pool, there are a few things to keep in mind. But with careful planning, you can enjoy all the benefits of owning a pool without breaking the bank.

If you choose to use a secured loan option, you may want to turn to your local bank or credit union for approval. If you choose to use a personal loan, let Acorn Finance help you unlock some of the best offers – without even leaving your home.

What are pool loan interest rates in Texas?

Pool loan interest rates in Texas vary depending on the type of loan you choose. If you decide to finance your pool with a home equity loan, the interest rate will be based on the current prime rate plus any additional margin added by the lender. For example, if the prime rate is 3% and the lender adds a 2% margin, your interest rate would be 5%. The average interest rate is from 3.5-20%.

However, if you choose to finance your pool with a personal loan, the interest rate will be based on your credit score.

The higher your credit score, the lower your interest rate will be. For example, if you have excellent credit, you may qualify for an interest rate as low as 5%. However, if you have poor credit, your interest rate could be as high as 20%. At Acorn Finance you can check personal loan offers for pool financing with APRs as low as 6.99%, depending on credit score.

How much does it cost to build a pool in Texas?

The cost of building a pool in Texas will vary depending on a number of factors, including the size and location of the pool, the type of materials used, and the amount of labor required. In general, however, it's estimated that the average cost of building a pool in Texas will be between $30,000 and $70,000.

This price range does not include the cost of maintaining the pool or any other associated costs. For those looking to add a pool to their home in Texas, it is important to consult with a professional to get an accurate estimate of all associated costs.

How to qualify for a pool loan in Texas?

In Texas, a home equity line of credit (HELOCs) and home equity loans are popular financing options for pools. However, to qualify for either of these loans, you typically need to have at least 20% equity in your home. If you don't have enough equity, you may still be able to get a personal loan from a bank or credit union.

However, these loans usually have higher interest rates and may require collateral, such as a car or boat. If you're not able to get a loan, you could also consider using a pool financing company. These companies specialize in pool loans and often have more flexible terms than banks and credit unions. Another option that may be worth exploring is a personal loan. At Acorn Finance you can check personal loan offers for pool financing loans up to $100,000, depending on credit score. Personal loans allow you to borrow money without collateral or a down payment with a fixed monthly payment. Regardless of how you finance your pool, make sure to shop around and compare interest rates before choosing a lender.

What is the cheapest way to finance a pool in Texas?

A swimming pool is a significant investment, and it's important to do your research before taking the plunge. In Texas, there are a few different options for financing a swimming pool loan. One option is to work with a local bank or credit union. Another option is to apply for a home equity loan, which can offer lower interest rates and longer repayment terms. You may also be able to finance your pool through a personal loan, though you may have to pay higher interest rates. Ultimately the option that is the cheapest will vary depending on the circumstances. Whichever route you choose, make sure to compare interest rates and terms before making a decision.

What credit score is needed for a pool loan in Texas?

In Texas, the minimum credit score needed for a pool loan is typically around 600. However, lenders can also consider other factors such as your employment history, income, and debts. If you have a strong credit history and steady income, you may be able to qualify for a loan with a lower interest rate. In addition to your credit score, the size of the loan and the term of the loan can also affect your interest rate.

Is financing a pool in Texas a good idea?

Financing a pool in Texas is a great idea, as long as you can handle the monthly obligation. Texas has some of the hottest weather in the country, so a pool is a great way to stay cool. Plus, pools can add value to your home. If you finance a pool, you can pay it off over time and avoid the big upfront cost. There are also many different financing options available, so you can find one that fits your budget.

When you finance a pool, you can also get access to special features like installation and maintenance services. This can save you money and hassle in the long run. So, if you're thinking about financing a pool in Texas, there are plenty of good reasons to do it. When you're ready to check offers for pool financing, visit Acorn Finance. Within 60 seconds or less you can check home improvement loan offers for pool financing. Not only can you access multiple personalized loan offers from top national lenders but your credit will not be impacted from checking offers.

Ready, set, jump into the best pool financing loans. . . check offers today!

Looking For More Pool Financing Options?

- Pool Financing in Arizona

- Pool Financing in California

- Pool Financing in Florida

- Pool Financing in North Carolina

- Pool Financing in Texas

See also:

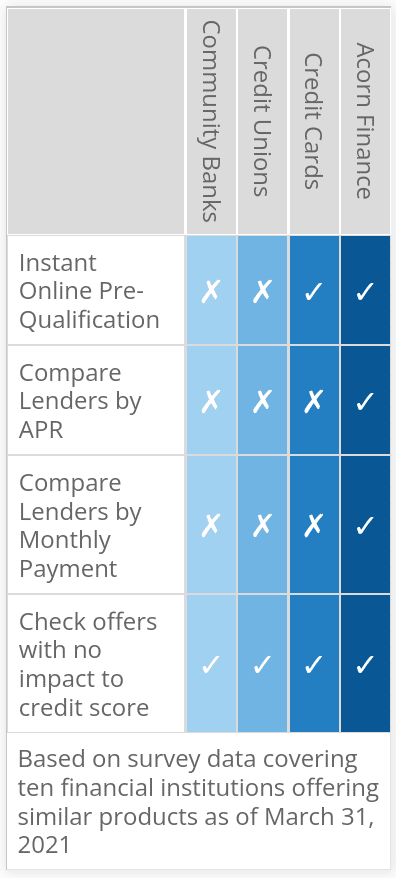

How Does Acorn Finance Compare?

How can I get a personal loan fast?

Check OffersCompare Rates From Top Lenders

Pool Financing Calculator

Are you a contractor?

Generate more revenue with Acorn Finance.

Offer customers the ability to finance their dreams with zero dealer fees.

Get StartedPopular Home Improvement Projects

Barn Financing Options

One home, endless possibilities