Pool Financing Georgia

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Georgia Pool Loans

Georgia summers are hot with an average high of 95 degrees F. Residents dream of a swimming pool in the privacy of their own yard to cool down in and have some summer fun. So how do you make this daydream a reality? Homeowners often use pool financing in Georgia to afford a swimming pool.

Pre-qualify

Select offer

Finish application

Receive funding

Check offers

in seconds

Won't impact

credit scores

Competitive

payment options

Receive

funds quickly

Compare Rates From Lenders in Our Network

Learn More About Pool Financing Georgia

Keep reading to learn more about building/installing and financing a pool in Georgia.

Read more - FAQ

+Can you get a swimming pool loan in Georgia?

Yes, you can finance an inground or above ground pool in Georgia. In fact, there are a few different ways to finance a swimming pool in Georgia. One option is to take out a home equity loan or line of credit. This can be a good option if you have equity in your home and you're comfortable with the idea of using your home as collateral. Secured loans such as these are usually best for more expensive pool projects. The application process can be lengthy and qualification requirements can be strict.

Alternatively homeowners often use home improvement loans, also known as personal loans, to finance a pool in Georgia. Georgia has many local banks and credit unions that can offer home improvement loans, but you may find the best deals online. There are a number of online lenders that offer home improvement loans in Georgia. Home improvement loans do not require collateral and can be funded in just a few days. They can be a good option for less expensive pool projects, say $100,000 or less.

Another option could be to finance through the contractor. Some contractors may partner with third party lenders to offer financing for customers. While this can be a convenient option, it may not always be the most cost-effective option.

How to finance a pool in Georgia?

There are a few things to keep in mind when shopping for a swimming pool loan in Georgia. First, make sure to compare interest rates and terms from multiple lenders in order to get the best deal. Second, be aware that some lenders may require collateral in the form of equity in your home in order to approve the loan. Finally, make sure you have a clear understanding of all the fees and charges associated with the loan before signing any paperwork.

When you're ready to shop offers, take advantage of Acorn Finance to compare home improvement loans. If you prefer to use a secured loan, visit your local bank or credit union to see what they can offer. Most lenders will start the process with a basic application.

What are pool loan interest rates in Georgia?

Pool loan interest rates in Georgia can vary depending on a number of factors, including the type of pool, the size of the loan, the creditworthiness of the borrower, and so forth.

However, most pool loans in Georgia have an interest rate between 6% and 28%. Borrowers with good credit may be able to qualify for a lower interest rate, while those with poor credit may be subject to a higher rate. In general, pool loans are relatively easy to obtain, and the interest rates are typically lower than those for other types of home improvement loans. As such, they can be a great option for homeowners who are looking to finance the purchase of a new pool.

How much does it cost to build a pool in Georgia?

The cost of building a pool in Georgia can vary depending on a number of factors, including the size and type of pool, the location, and the contractor. In general, however, the average cost of building a standard in-ground pool is between $20,000 and $60,000.

This price range includes the cost of materials, labor, and permits. If you want to add features such as a spa or waterfall, the cost can increase dramatically. To get an accurate estimate for your project, it is best to consult with a local pool contractor. They should be able to assess your property and give you an estimate for the total cost of the project.

How to qualify for a pool loan in Georgia?

In order to qualify for a pool loan in Georgia, you will need to meet certain criteria. Most lenders will have a minimum credit score and income requirement, along with other requirements. A majority of lenders would like to see a credit score of 660 or better, but that doesn't mean you can't qualify with a lesser score. To qualify for a pool loan in Georgia you should have established some credit and have steady income at the very least. To find out if you qualify, you'll need to get pre-qualified which usually entails submitting an application.

What is the cheapest way to finance a pool in Georgia?

One of the most important factors to consider when financing a pool in Georgia is the cost. There are a variety of ways to finance a pool, but not all methods are created equal. Ultimately the cheapest way will come down to what you qualify for. Home equity loans and home equity lines of credit are often cheapest, but also the most time-consuming and riskiest. We encourage borrowers to compare different loan types and the pros and cons of each option. The cheapest option may not always be the best option. Make sure you look at fees and total loan costs, not just a monthly payment.

Is financing a pool in Georgia a good idea?

In Georgia, purchasing a pool is a big financial decision. There are a few things to consider when making this decision, including whether or not you will use the pool often and how much you are willing to spend on maintenance and utility costs.

If you are certain that you will use the pool frequently and are prepared to budget for the additional expenses, financing a pool in Georgia can be a great way to enjoy your backyard and make lasting memories with family and friends.

What credit score is needed for a pool loan in Georgia?

In order to qualify for a pool loan in Georgia, you should have a credit score of at least 660. However, if your score is lower than 660, you can still qualify. Some lenders can help borrowers with credit scores in the 500's. If you're unfamiliar with your credit score you should request a free copy of your credit report from one of the three major bureaus. Next, check lender requirements. Find lenders that you qualify for and apply. To simplify this process, you can check offers at Acorn Finance.

Acorn Finance has a network of top national lenders that can help a variety of credit scores qualify for a home improvement loan. The best part – checking offers at Acorn Finance does not impact your credit score, Therefore, the worst thing that can happen is you are told no. If turned down, you can try to reapply with a cosigner. Acorn Finance lending partners can offer home improvement loans up to $100,000, depending on credit score.

Unlock some of the hottest pool financing offers in Georgia. . . check offers online today!

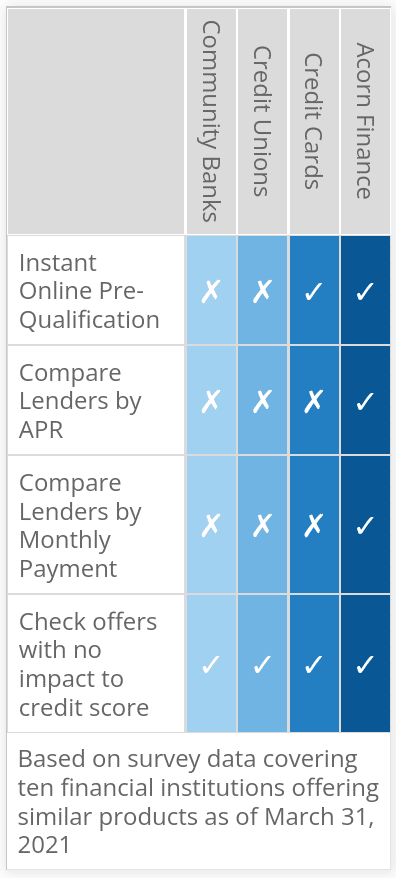

How Does Acorn Finance Compare?

Compare Rates From Top Lenders

$ Loan Calculator

Are you a contractor?

Generate more revenue with Acorn Finance.

Offer customers the ability to finance their dreams with zero dealer fees.

Get StartedPopular Home Improvement Projects

Barn Financing Options

One home, endless possibilities