Pool Financing in Florida For Good & Bad Credit

Compare monthly payment options from several lenders in under 2 minutes.

How much would you like to finance?

Swimming Pool Loans in Florida

If you’re a Florida homeowner, there’s a good chance you’re thinking about adding a pool to your property. After all, what’s more relaxing than taking a dip in your own backyard oasis? And if you’re like most people, the cost of building a pool is probably keeping you from diving in.

How To Finance A Home With Acorn Finance

Pre-qualify

Select offer

Finish application

Receive funding

Check offers

in seconds

Won't impact

credit scores

Competitive

payment options

Receive

funds quickly

Compare Rates From Lenders in Our Network

Learn More About Pool Financing in Florida

But don't worry – we've got some tips for pool financing in Florida, keep reading to learn more!

Read more - FAQ

+Can you get a swimming pool loan in Florida?

In Florida, swimming pools are a popular home improvement, and many homeowners take out loans to finance their construction. However, there are a few things to keep in mind if you're considering a loan for your pool. First of all, swimming pool loans are considered to be "secured" loans, which means that the lender will have a claim on your property if you default on the loan. Additionally, most lenders will require that you purchase specific types of insurance in order to protect their investment.

Secured loans can be hard to qualify for and come with several restrictions. However, you can get unsecured pool loans as well, depending on your situation. Personal loans can be used for pool financing in Florida.

Regardless of the type of loan you choose, it's important to shop around and compare rates before taking out a loan for your pool. By doing your homework, you can ensure that you get the best possible deal on your loan.

How to finance a pool in Florida?

Financing a pool in Florida can be a challenge, but there are a few options available to help make the process easier.

One option is to take out a home equity loan. This can be a great way to finance a pool because the interest rates are usually lower than other types of loans.

Another option is to finance the pool through a personal loan. This can be a good option if you have good credit and can qualify for a low-interest rate. You may also be able to finance your pool through your contractor. Some contractors offer financing options for their customers.

If you decide to finance your pool through your contractor, make sure to shop around and compare interest rates to get the best deal possible. Whatever option you choose, financing a pool in Florida can be a great way to enjoy the summer sun.

What are pool loan interest rates in Florida?

The type of pool you're looking to finance will play a role in the interest rate you're offered. For example, inground pools tend to have higher interest rates than above-ground pools. Additionally, the size of the loan and the term length will also impact the interest rate. That being said, here are a few examples of average pool loan interest rates in Florida:

For an inground pool loan with a principle of $10,000 and a term length of 60 months, the average interest rate is 4.99%. For an above-ground pool loan with a principal of $5,000 and a term length of 48 months, the average interest rate is 9.99%. These are averages, of course, and can vary between 5 to 36%.

How much does it cost to build a pool in Florida?

The cost of building a pool in Florida can vary greatly depending on the size and type of pool you want, as well as the location and any extra features you may want to include. In general, you can expect to pay anywhere from $35,000 to $65,000 for a basic inground pool.

Of course, if you want something more elaborate, such as a custom-built pool with a waterfall or other features, the price tag can quickly climb into the six figures. In addition, keep in mind that you will also need to budget for ongoing costs such as pool maintenance and repairs.

Still, despite the high initial cost, many Florida homeowners find that having a pool is worth the investment. Thanks to the warm climate, they are able to enjoy their pool year-round, making it a true oasis in their own backyard.

How to qualify for a swimming pool loan in Florida?

To qualify for a pool loan, you will usually need to have good credit and a steady income. In addition, you may be required to provide collateral, such as your home or another asset. Before applying, you should determine what type of loan you think is best. If you're going to use a secured loan such as a home equity loan or HELOC, you may want to turn to your local bank or credit union. However, if you're taking out a personal loan, an online lender may be your best bet. Personal loans generally have faster approval times and are easier to qualify for. Compared to secured loans though, they may come with higher rates. If you are building an expensive inground pool a secured loan might be your best option.

By doing your research and shopping around, you can find a loan that fits your budget and helps you fulfill your dream of owning a swimming pool.

What is the cheapest way to finance a pool in Florida?

In Florida, there are a few options for people looking to finance their pool. One popular option is to take out a home equity loan. Home equity loans allow homeowners to borrow against the equity in their home, using their home as collateral. Interest rates on home equity loans are typically lower than those of other types of loans, making them an attractive option for borrowers.

Another option for pool financing in Florida is to apply for a personal loan from a bank or credit union. Personal loans usually have higher interest rates than home equity loans, but they can still be a good option for borrowers who don't have much equity in their home or who don't want to use their home as collateral. For both home equity loans and personal loans, borrowers will need to have good credit in order to qualify. Borrowers with bad credit may still be able to get a loan, but they will likely pay a higher interest rate.

What credit score is needed for a swimming pool loan in Florida?

In order to finance a pool in Florida, you may need a credit score of at least 550 or higher, depending on several factors. With a credit score of 550 you may be limited on pool financing options. And most will come with high interest rates. If you have a low credit score or even fair credit score you should work on rebuilding your credit score before applying for a loan. Lenders usually have a unique set of qualification requirements so check with the lender of your choice to see what your chances of qualifying are before applying.

Be sure to compare interest rates, fees, and repayment terms before you choose a loan. With a little bit of research, you should be able to find a loan that meets your needs and helps you finance your dream pool.

Is financing a pool in Florida a good idea?

Pools are a great way to beat the heat, but they can also be a significant financial investment. In Florida, a pool is one of the most expensive home improvement projects. However, there are a number of financing options available that can make owning a pool more affordable.

Luckily, Acorn Finance makes financing a pool in Florida easy, even if you have less than perfect credit or no collateral. Acorn Finance partners with a network of top national lenders to provide personalized loan offers for consumers. Simply submit a form online and receive home improvement loan offers within 60 seconds or less. The best part – your credit score will not be affected by checking offers.

Dive in with confidence. . . shop pool financing offers from top national lenders today!

Looking For More Pool Financing Options?

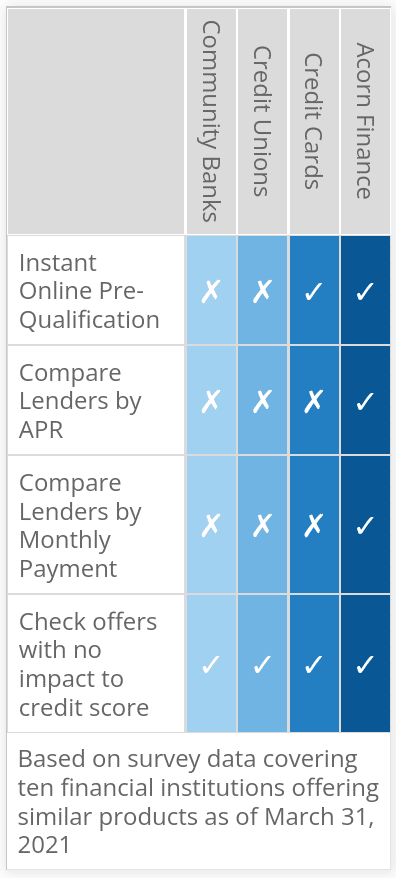

How Does Acorn Finance Compare?

Compare Rates From Top Lenders

$2000 Loan Calculator

Are you a contractor?

Generate more revenue with Acorn Finance.

Offer customers the ability to finance their dreams with zero dealer fees.

Get StartedPopular Home Improvement Projects

Barn Financing Options

One home, endless possibilities