Home Improvement Financing for Contractors

Contractor Financing for Customers Made Easy

Personalized rates in 60 seconds with no credit score impact

Homeowners

Contractors

Software Providers and Merchants

Compare Rates From Top Lenders

Pay no dealer

fees at all

Doesn’t impact

credit scores

Competitive payment options

Customers receive

funds quickly

How Acorn Finance Works for Your Customers

Pre-qualify

Select offer

Finish application

Receive funding

Acorn Finance helps you grow revenue, for free.

Whether it’s a kitchen or bathroom remodel, new roof, windows, siding or an HVAC repair, Acorn Finance offers flexible home improvement financing for dealers and contractors that help you close more sales.

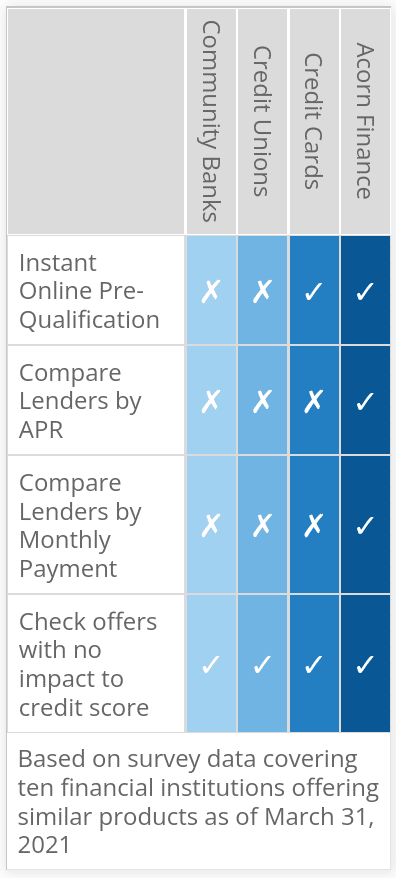

How Does Acorn Finance Compare?

Learn More About Financing for General Contractors

Contractor financing can allow your business to close more deals and keep all the money while improving customer satisfaction. It provides your customers an affordable financing option to pay over time and is 100% free for you. As a result, your business can be more profitable while being a more valuable option for customers. It really is a win-win for everyone involved! AcornFinance.com is a reliable company that simplifies contractor financing. Simply apply online and be up and running in 24-hours. Keep reading to learn more about contractor financing.

What does contractor financing mean?

Do you ever dread telling customers their total, fearful they won’t have the cash to pay for it? Using contractor financing allows you to get paid upfront while allowing your customer to pay over time. Companies that offer contractor financing essentially act as a bridge that connects customers with financing options.

What are the benefits of contractor financing for your business?

Offering contractor financing can give your business a competitive edge while becoming a more valuable option for customers.

Let’s look at how your business can benefit from contractor financing.

#1. Close more sales

Providing customers a way to afford your product or services is the secret to closing more sales. It can also discourage customers from shopping around for more affordable options.

#2. Guaranteed payment for your work<

Even though your customers get to pay over time, you will be funded upfront for your product or services using contractor financing. You don’t assume any liability if your customer defaults on payments in most cases.

#3. Increase average job size & revenues

Offering contractor financing can help your business increase its average job size and revenues. It’s much easier to close someone on “$20 more per month” versus “an additional $2,500 upfront.” Statistics show that about 50% of homeowners finance renovations and repairs over $5,000.

#4. Improve customer satisfaction

Contractor financing can improve your customer experience. Knowing you can afford the product or service you’re shopping for can put customers at ease. This allows them to get exactly what they want for a monthly payment they can afford. Overall, this can improve their experience and satisfaction levels.

#5. Reduce job cancellations

The stress of limited cash flow can cause customers to put off projects and cancel appointments. However, contractor financing can help reduce job cancellations. Customers may feel more committed at the time of making the appointment and arranging financing. They may also feel more excited and less stressed about the financial portion of the project.

#6. Be a more valuable option

Customers shopping for expensive products or services may seek out a company that offers contractor financing. By offering contractor financing your company can become a more valuable option.

What are the benefits of contractor financing for your customers?

Contractor financing can not only benefit your business but your customers too!

Let’s look at how your customers can benefit from contractor financing.

#1. Simplifies financing

Contractor financing can simplify financing for customers. If you don’t offer it customers are forced to secure financing on their own and hope you can work with their loan. Going through the motions together can simplify the financing process for your customer and your business.

#2. Easier decision making

Customers can experience easier decision making knowing they are not responsible for paying cash upfront. This can provide them more flexibility during the design and shopping phases. In addition, when it comes time to finalize the deal they should have less to think about. All they have to do is sign and keep up with their affordable monthly payments.

#3. Faster job start

Lenders that partner with Acorn Finance must deliver funds within 48-hours of approval. This can speed up your job start date while increasing customer satisfaction.

#4. Allows for better quality and larger projects

Often times you may struggle to make a project fit within your customers budget. Contractor financing can remove these struggles and allow you to do better quality work.

What are the drawbacks of contractor financing for your business?

Compared to the benefits of contractor financing there are very few drawbacks in our opinion.

Let’s look at the drawbacks of using contractor financing.

#1. More time with customers

More time spent with customers can be viewed as a positive or negative. While it can improve customer relationships it can also take away from helping new customers. However, at the end of the day if contractor financing increases revenues then it should be worth the time.

#2. May require more staff

In order to increase sales you should have a well-trained employee(s) to consult customers on financing options. Acorn Finance provides specialized regular training to help keep your staff up-to-date. In addition, they provide monthly data analytics. The training and analytics costs you zero dollars.

What are the drawbacks of contractor financing for your customers?

Similar to the drawbacks for your business, there are few drawbacks for your customers.

Let’s look at the drawbacks for customers using contractor financing.

#1. May need credit to qualify

Acorn Finance offers financing options for good and bad credit borrowers and has a high approval rate. However, in most cases some kind of credit is needed to qualify.

#2. Taking on debt

Customers will be taking on debt by financing renovations or repairs. The good news is that Acorn Finance offers very competitive interest rates and terms. This can help keep monthly payments down. Some lenders do not have prepayment penalties so customers can pay their loan off faster.

How can a contracting business offer financing?

Offering contractor financing is quick and easy using AcornFinance.com. To get started, simply apply online to register your company. Acorn Finance offers straightforward and competitive financing options while partnering with reliable lenders. Your business can be offering contractor financing within 24 hours using Acorn Finance.

What lenders does Acorn Finance partner with?

Acorn Finance partners with reliable lenders that can offer competitive financing offers to good and bad credit borrowers.

Here are some of the lenders Acorn Finance partners with.

- PayPal

- Capital One

- Chase

- American Express

- SoFi Personal Loans

- Blue Vine

- LightStream Personal Loans

- Best Egg

- Prosper Personal Loans

Does Acorn Finance require lenders to meet certain requirements?

Lenders that partner with Acorn Finance are required to meet certain requirements to improve customer satisfaction.

Lenders that partner with Acorn Finance must meet the following requirements.

#1. Quick application process

Lenders must be able to provide a quick application process that lasts 2 minutes or less.

#2. Fast pre-approval

Lenders must be able to pre-approve borrowers in under 10 seconds. Your customer will receive multiple pre-approval offers allowing them to choose the one that is best for them.

#3. Quick funding

In most cases, lenders are required to deposit funds within 48-hours of approval. Prior financial issues such as bankruptcy can interrupt this process.

#4. Eradicate of all completion certificates

You set the contract with the customer and receive funds from the lender.

#5. High loan amounts

Acorn Finance requires that lenders must offer loans up to $100,000.

#6. Borrower credit score not affected by application

Acorn Finance requires that borrowers credit scores must not be affected by applications.

Does Acorn Finance charge money for financing to customers?

Acorn Finance does not charge customers for financing. The lender that funds the loan typically pays a small percentage to Acorn Finance. However, this does not affect the customers loan or terms.

Does Acorn Finance charge dealer fees?

Acorn Finance is 100% free to contractors and charges no dealer fees. AcornFinance charges lenders a small fee to make money.

6 Reasons why contractors love Acorn Finance

Acorn Finance is a leading provider for contractor financing that is committed to satisfying you and your customers.

Here’s 6 reasons why contractors love Acorn Finance.

#1. No dealer fees

Acorn Finance is 100% free for dealers. Instead of charging dealer fees they charge lenders a small fee.

#2. Competitive payment options

Acorn Finance partners with multiple lenders to increase the competitiveness of their offers. Loans up to $100,000, with terms up to 12 years and rates as low as 6.99% are available.

#3. Doesn’t impact credit scores

Customers can apply online and receive pre-qualified offers without affecting their credit score.

#4. Easy to activate

Contractors can apply online and be up and running in 24 hours.

#5. Quick funding

In most cases, funds are available within 48-hours of approval.

#6. Free data analytics and ongoing training

Acorn Finance provides specialized training on a regular basis and monthly data analytics. The data analytics can help you identify weaknesses or insufficiencies in your sales and marketing practices. Acorn Finance will provide training to help rectify any issues.

What is contractor financing?

If you own a business, you can receive advanced funding on a contract you already have so that your contract can be complete. You are basically getting a loan to help you pay for the rest of the contracted work. Before you can receive contractor financing, the lender will usually analyze the terms of the contract. They will probably also look at the credit score of the person who is requesting the financing. They will often consider the person’s credit score, not the financial situation of the business itself.

Contract financing is usually different than a traditional loan or bank financing because it’s usually based on the business contract you have already signed. The lender might also require that you pay the loan back in milestones or on a certain timeline. This can be very different than traditional monthly payments that you might have experienced with other loans in the past.

Contractor financing can also be when a customer takes advantage of financing offered by a contractor. The term “contractor financing” can go either way.

How do contractors get financing?

Most contractors gain financing by working with third-party lenders. If contractors want to offer financing for customers, they can partner with lending network companies such as Acorn Finance. Acorn Finance provides contractors with a platform that allows customers to check offers quickly, without impacting their credit score. The contractor can close more deals by offering affordable financing options and the customer can now afford the project they need or want done. It’s a win-win situation.

If contractors need financing for business purposes or a specific project, they can visit their local bank or credit union. They may also consider using a personal loan. Just like their customer can secure a personal loan through Acorn Finance, so can the contractor.

Do contractors let you finance?

Some contractors offer financing options, but it’s usually through a third party lender. In some cases, contractors may allow a customer to make payments but it’s usually a few large payments as opposed to several smaller monthly payments. If the contractor of your choice does not offer financing, you can still obtain financing for your project and work with the contractor of your choice. Some homeowners will use a personal loan for home improvement projects while others may use a secured loan such as HELOC or home equity loan. You should evaluate project costs and your financial situation to choose the type of loan that is best for you.

In some cases, lenders may evaluate the legitimacy of the contractor as well as the creditworthiness of the borrower. Whether the lender does or does not check out the contractor, you should do your due diligence. You will want to work with a contractor that is experienced and reputable to ensure work is done properly. If you are using financing offered through the contractor, their legitimacy will be even more important. The last thing you want is to be scammed out of any money or left with an incomplete project.

What is contractor funding?

Contractor funding is how a contractor can receive funding to build the project before the customer might pay for them. Sometimes the contractor will ask you to go through a third party to gain funding, and sometimes they will have their own way of funding or giving you a loan and then you will pay them back in installments.

Some contractors might use a line of credit which is considered more flexible funding. This allows the contractor to purchase things on the credit card and then pay it back when you give them your monthly payment. Some contractors also use business credit cards that give them rewards and incentives for making certain purchases.

Do most contractors offer financing?

Larger contractors are more likely to offer financing, but that does not mean that small contractors cannot offer financing too. You should ask the contractor of your choice if they offer financing options. However, you should also compare financing options. Assuming that the contractor has the best options available may be a mistake. As we mentioned earlier, if a contractor does not offer financing, you can still finance the project. You will just need to go in search of a personal loan or a secured loan. There may be other financing options available too, it really just depends on your situation. If you are a contractor that wants to offer financing, consider partnering with Acorn Finance.

How does contractor financing work?

In most cases, contractors that need to borrow money to complete a project will use contractor financing. It’s common for contractors to collect a deposit to start a project, but wait to collect payment in full until the work is complete. However, if the contractor has to pay workers or buy materials, and they have not been paid in full for the project, they may need to use financing. Finding contractor financing can be difficult and time-consuming, so many people choose to start the process early to speed up the funding. Requesting proof of funds to ensure that your customer can pay for the project is important. You will also want to have a binding agreement that outlines payment(s), work, and anything else that is agreed upon. Lenders will likely want to see your contract and the clients ability to pay for the project.

What are the benefits of contractor financing for customers?

Contractors that offer financing can offer more affordable services for customers while closing more deals. Homeowners often want to know what home improvement projects costs. The contractor can go out and provide an estimate. When they give the customer the estimate, the customer may express that they are unable to move forward right away, but perhaps down the road they can. This is a common objective that can be overcome with the ability offer financing. Customers can get home improvement projects done while enjoying the flexibility of making monthly payments over time.

Alternatively, if a contractor is using financing to cover project costs, they can ensure their business has healthier cash flow and that they do not lose out on a project due to a lack of funds. Both customers and contractors may need to use financing. Luckily, Acorn Finance can help both customers and contractors secure financing for home improvement projects.

Conclusion

In conclusion, contractor financing has more pros than cons. It can increase your sales and revenues and is 100% free for your business. Partnering with a reliable company such as Acorn Finance can make all the difference for you and your customers. They strive to go the extra mile providing support and training while partnering with top-rated lenders.

Ready to increase your sales?

How To Offer Financing as a Contractor

If you are a contractor who wants to offer financing or a homeowner looking for a contractor that offers financing near you, keep reading. Below we will explain what contractor financing is, how contractors can offer financing, why contractors should offer financing, and more.

How and Why to Offer Financing as a Contractor

Financing offered by contractors can benefit the contractor and the customer. For the contractor, offering financing options can improve customer satisfaction, access guaranteed payment, increase revenue and job size. Customers can benefit from reduced stress, access to larger projects, and faster start and completion dates. Needing something and being unable to afford it can be a frustrating feeling. Especially, when it comes to home repairs or improvements. In some cases, you may need an emergency repair forcing you to find a way to afford it. Contractor financing can provide customers an affordable solution that allows them to make home improvements or repairs. In addition, good and bad credit borrowers can qualify for financing. Acorn Finance offers contractors a user-friendly and convenient way to offer customers financing. The service is free for the contractor and the borrower. Customers can apply quickly and receive same-day funding. Contractors can visit Acorn Finance to sign up and learn more about what they can offer. Once you are an approved contractor you can offer home improvement loans up to $100,000 with interest rates starting at just 4.49%.

What is financing for contractors?

Contractors can offer financing for customers allowing customers to pay over time while the contractor still gets paid in full upfront. Contractors can provide services to connect customers to lenders who can loan money to homeowners. This means you as the contractor does not actually lend the money or assume any risk. The contractor can act as a bridge to provide customers financing. Acorn Finance is a top-rated option for contractors that want to offer competitive financing for customers.

How do you offer financing to customers?

Contractors wondering how to offer financing to customers should visit Acorn Finance. To get started, contractors can submit a quick and easy application. Once your application is approved Acorn Finance will provide the tools and resources you need to start offering financing. Contractors can keep 100% of profits and enjoy no sign-up fees, subscription fees, or dealer fees.

How do contractors offer financing?

The most common way for contractors to offer financing is to partner with third-party lenders. This means the contractor connects the homeowner with a lender that provides financing. Acorn Financing can help contractors connect homeowners to trustworthy lenders with competitive offers. Contractors can help homeowners complete the application and approval process online and receive instant pre-qualification offers for customers.

Is offering financing right for me?

There are more reasons to offer financing than there are not to offer financing. In most cases, there is no reason for a contractor to not offer financing. Studies prove that offering financing can increase revenue and job size and improve closing ratios.

5 Reasons You Should Offer Financing

We have covered 5 reasons why contractors should offer financing. However, there are many more reasons why you should offer financing. Offering financing is one of the best ways to expand your business and close more deals. If you are hesitant to give it a try, just remember it’s completely free to offer financing through Acorn Finance. Chances are once you start offering financing you will be in disbelief there was a time you did not offer financing. However, if for any reason you want to stop offering financing it’s easy and penalty-free through Acorn Finance.

1. Financing helps make the sale for large orders

A common scenario contractors experience is delivering a bid to a homeowner and receiving a shocked response due to the project cost. If homeowners can’t afford the project they can scale back the scope of the project or do it in phases. In some cases, they may have to delay the start or decide not to do the project at all. None of these options are ideal for contractors. Being able to offer customers an affordable financing solution with easy qualification standards can put them at ease. Customers will be more likely to complete projects using financing.

2. Allow payment flexibility for your customers

Contractors can offer financing options with terms up to 12 years, payment deferral, and no early pay-off penalty. Homeowners can take advantage of flexible terms and payments. Some lenders that partner with Acorn Finance may offer payment deferral so that homeowners do not have to start repayment until the project is complete.

3. Boost sales by offering clients a monthly payment

Contractors can increase sales and project size by offering financing options with affordable monthly payments. If homeowners have a budget and your estimate exceeds their budget, they can put some money down and finance the rest. You can help homeowners estimate monthly payments to find a solution that fits their budget.

4. Close rates tend to jump 18%

Studies show that contractors that offer financing see close rates increase about 18% and job sizes increase about 30%. Evidence states that offering better payment options encourages customers to pick better solutions. Since offering financing through Acorn Finance costs contractors zero dollars, this is a big increase in revenue without additional expenses.

5. Increase margins by upping your work price

If you have a well-established company with five-star reviews and a lot of repeat and referral business you may be able to charge more for your work. In addition, offering affordable financing options can make customers less focused on the total cost. Providing customers a way to pay for your services can also reduce the chance of them shopping around for estimates. If you can provide the service they need and they want you to do the work and you have a payment option that works for them, it’s likely they will just say yes to your estimate.

How do you finance a customer?

It depends. What kind of financing are you offering? Are you financing a customer with your personal funds? Are you offering a customer a payment plan? Do you partner with a company like Acorn Finance?

In some cases, a contractor may want to offer in-house financing. If they do, they should seek legal advice so they can determine how to offer financing. In-house financing may be profitable but it can also be very risky. There really is no reason to take the risk with so many safe options available.

In some other cases, you may offer a payment plan. Say the customer has a project that will be completed in phases. If they can afford to pay for the project in cash as each phase is completed, you may be able to work with them. Make sure you get a written agreement though, even if they are a close friend or family member.

In most cases, it’s best to leave financing to a 3rd party lender. This eliminates any additional risk of financing or payment plans the contractor may assume. If you partner with Acorn Finance, your customer can simply apply online or use a mobile application to check financing offers. If they feel the financing offers are fair and one can work for them, they can agree to have the work done. The customer will finalize the approval with the lender and receive funds. While you showed them the best way to finance their project, they are essentially a cash customer in your eyes.

Should I give a contractor a deposit?

In some cases, it may be normal to pay a deposit to your contractor before they have completed any work. However, you should be very careful when doing so. A deposit of 10% or in some states even 20% may be acceptable. It depends what the State License Board allows.

In most cases, you can find contractors willing to provide free estimates. However, this does not mean you should call them all and invite them to your home. There should be a serious due diligence process that goes into picking a contractor that will be working in or near your home. You will want to find a reliable, trustworthy, and experienced contractor with a superb reputation. This kind of contractor may cost more, but it’s likely worth every extra penny.

If you trust a contractor and have spoken to previous customers, or maybe you were even referred by one, you can give them a deposit with confidence. Afterall, it’s not completely unreasonable for them to ask for one. Once you hire them, they are going to be investing their own time and money into your project, in hopes that you fulfill your end of the agreement. A deposit can give you both a little skin in the game.

How much money should you give a contractor up front?

As we mentioned in the previous section, you should check State License Boards. In most cases, it’s acceptable to pay a contractor a 10% to 20% deposit. If a contractor needs funds to purchase materials, the homeowner should pay the supplier directly, rather than giving funds to the contractor before the project is complete. Whether you are required to pay a deposit or not, you should make sure that payment terms are clearly stated in your agreement.

Realistically, a deposit more than 10% is something you should avoid at all costs. There are plenty of high quality contractors to choose from. As you gather estimates you should ask questions such as how much deposit will be required. In addition, as a contractor that wants more business, you should ensure to follow all guidelines, including deposits.

Is offering financing risky for my business?

As long as you partner with reliable lenders or companies that allow you to offer financing, it should not be risky. While with any business transactions there are risks involved, offering financing should not present significant risks that make you want to think twice. When you partner with a reputable company like Acorn Finance you can minimize any risk involved with offering financing. Acorn Finance vets all lending partners to ensure only good business transactions occur. When you partner with Acorn Finance, you do not have to sift through a long list of lenders and learn how they operate.

In addition, when you use Acorn Finance, you are removed as the middleman. Customers can use a mobile application to apply and secure financing. Within 60 seconds or less customers can compare personal loan offers without any impact to their credit score. If they do qualify and want to proceed with the loan, they can receive funds 24-48 hours after submitting the lender’s online application. This means that the customer is now responsible for paying you in full for the work you perform. All you had to do was show them how easy financing is to secure. If they default on the loan, the contractor is not punished. Essentially the contractor is only responsible for connecting the borrower to the Acorn Finance platform. The contractor does not collect or submit any application themselves, nor do they need to present any offers. The customer is responsible for doing any necessary due diligence on their own.

How do I safely offer my clients financing as a contractor?

As a contractor, you are not in the business of financing. However, you are in the business of making money and quoting expensive projects. You probably run into your fair share of curious homeowners on a day-to-day basis. You get called out for a free estimate and hear a story along the lines of, ‘we have been wanting to do this project for years but have no idea what it will cost or if we can afford it.’ Now stop there. You may be thinking, another wasted hour of my time. Another expensive quote that the homeowner cannot afford.

But, what if you could answer both of their questions. Not only can you tell them what the project may cost but you can show them that they can afford it. While you may be eager to close more sales, you will want to make sure that financing is safe for you and your customers. As a contractor, you have a few options when it comes to safely offering financing for customers. There are a variety of companies that you can partner with to offer financing. In addition, you may want to make a friend at the local bank if they offer home improvement loans for good and bad credit. If you do not want to offer financing, you should at the very least, have some recommendations on where a customer can go for financing.

If you are looking for a safe and hassle-free way to increase revenue and offer financing, you should visit Acorn Finance.

Conclusion

In conclusion, Acorn Finance can help contractors offer financing for customers. Most of Acorn Finance’s lending partners offer $1,000, $1,500, $2,000, $3,000, $4,000, $5,000, $10,000, $20,000, $25,000, $50,000, up to $100,000 without any spending restrictions. On approved loans, customers can receive funds as a lump sum. This means contractors can get paid right away and customers can pay over time. Offering financing is the key to growing your business and generating more revenue.

Offer contractor financing and increase sales. . . enroll today!

Are You A Contractor?

Stop Thinking & Start Doing with Acorn Finance.

Offer customers the ability to finance their dreams with zero dealer fees.

Get StartedPopular Home Improvement Projects

Barn Financing Options

One home, endless possibilities